A Reclusive Heiress, $300 Million, And A Contested Will

This is super fascinating, entertaining, and oh so very complicated. But we break it down and offer helpful lessons along the way. Get comfy!

There are so many issues raised in this story — multiple Wills, inheritance rights, how and why to contest a Will, and the sometimes fine line between eccentricity and incompetence — that we'll be breaking out the key points to keep everything clear.

The Cast Of Characters

- Huguette Clark, reclusive multi-millionaire heiress and philanthropist (1906-2011)

- Wallace Bock, Ms. Clark's attorney

- Irving Kamsler, Ms. Clark's accountant

- Hadassah Peri, Ms. Clark's longtime private nurse

- Beth Israel Medical Center in New York, where Ms. Clark lived for the last two decades of her life

- The Corcoran Museum of Art, Washington, D.C., where Ms. Clark's father (the copper baron and U.S. senator from Montana, William A. Clark) served as trustee, and to which both Mr. Clark and Ms. Clark had donated significant amounts of money and art

- Ms. Clark's extended family, including 21 half-grandchildren, half-great-grandchildren, and grand-half-nieces and nephew of Ms. Clark's half-sisters and half-brother

The Key Facts

- The value of Ms. Clark's estate at the time of her death: $306,489,687.23

- The number of wills Ms. Clark wrote in her life: 3 (1929, March 2005, April 2005)

- The year Ms. Clark was diagnosed with dementia: 2010

- Ms. Clark's age at her death: 104

Huguette Clark was the daughter of William A. Clark, a copper baron who made his billion dollar fortune in the late 1800s. When he died in 1925, Ms. Clark inherited $500-700 million dollars. Mr. Clark donated his large (and very valuable) art collection to the Corcoran Museum of Art in Washington, D.C., where he had served as a trustee. Ms. Clark also inherited some of her father's art, and continued to collect art herself.

In 1928 Ms. Clark married, though she had no children and the marriage ended in divorce 2 years later. Ms. Clark penned her first Will in 1929, as she contemplated divorce. In that first Will she left everything she owned to her mother, Anna La Chapelle Clark. Ms. Clark's mother died in 1963; Ms. Clark did not draft a new Will for another 75 years. (According to this first Will, the Corcoran Museum would—by default—receive a $3 million Trust created by Ms. Clark's mother.)

But 75 years later, in March 2005, Ms. Clark did write a new Will. In this new will, $5 million would go to Ms. Clark's private nurse, Hadassah Peri, and the rest of her fortune would be distributed among her remaining extended family. The Corcoran Museum would receive nothing.

Then, only 6 weeks later, Ms. Clark wrote a third Will. In this will, 15 percent of the fortune would go to creating an arts foundation at her Santa Barbara, CA mansion, which would also be the recipient of all but one of her pieces of art. The Corcoran Museum would receive her Monet "Water Lilies" painting from 1907, valued at $25 million. $2.6 million would be divided among her doctor, her personal assistant, her lawyer Wallace Bock, her accountant Irving Kamsler, and Beth Israel Medical Center (the hospital where Ms. Clark resided for nearly 20 years). (Mr. Bock and Mr. Kamsler were also named as executors to Ms. Clark's estate, a job that would pay them roughly $8 million.) Sixty percent of her remaining estate and her extensive and valuable doll collection would go to her nurse, Ms. Peri. A goddaughter would receive 25 percent of the remaining estate. Ms. Clark's extended family would receive nothing.

Upon Ms. Clark's death on May 24, 2011, the April Will was revealed. Then the March Will was also revealed. Given the proximity of the dates that the March and April Wills were signed, and given the stark differences in the instructions, there was cause for inquiry.

On the one side is Ms. Clark's extended family and the Corcoran Museum. The family argues that the third Will was "improperly executed" and that Ms. Clark had been "taken advantage of by Mr. Bock, Mr. Kamsler, Ms. Peri, and others." The family believes that not only had Ms. Clark been coerced into writing and signing the April 2005 Will, but also that Mr. Bock and Mr. Kamsler, her attorney and accountant, had mismanaged her affairs in her life, which resulted in unpaid taxes and forced her to sell numerous valuable paintings. The Museum has joined in supporting the family in their case; some are questioning the Museum's motives. (Ms. Peri's lawyer has suggested that the Museum "may be doing the bidding of family members when they should be doing the bidding of the beneficiaries of the Corcoran." The Museum says it must respect the “true intentions” of donors.)

On the other side, Ms. Clark's attorney and accountant claim that they served Ms. Clark well in her life, and her most recent Will should be honored. Beth Israel Medical Center also believes that the April 2005 Will should be upheld. In response to charges of the mismanagement of Ms. Clark's estate, Mr. Kamlser's attorney said, "He was doing the absolute best that he could looking out for her interests and complying with her wishes." Mr. Bock's attorney said of Ms. Clark, "She wanted to spend her money the way she wanted to spend it. [Bock] was hired to do what she wanted him to do." Beth Israel Hospital, which received money and a Manet painting (valued at $3.5 million), said in a statement, "We are disappointed at the attempt to take back charitable donations that Ms. Clark freely made to Beth Israel to express her gratitude for the hospital’s life-saving and compassionate care, and her recognition of the hospital’s important mission."

Considering how much money is at stake, it is obvious why so many parties have such strong feelings about which will should be honored. But who's right? Who can know what Ms. Clark intended? At this point, it is up to the Surrogate Court of New York to determine which of Ms. Clark's wills—her original will from 1929, her will from March 2005, or her will from April 2005—is the valid Will.

Contesting A Will

When a Will is submitted to probate, the court is charged with determining whether or not it's a valid legal document — that is, whether or not the Will is legally binding and was in fact created by the person who it represents (known as the "testator"). This is usually done by a judge simply looking at the document and determining whether or not it meets the state's requirements for a legal Will.

But a Will can be contested. Even if the judge says that the Will looks good, the validity of it can be challenged.

There are two types of people who can contest a Will: people who are named as beneficiaries and people who would be beneficiaries if the Will was invalid.

There are four reasons a Will may be argued (and found) to be invalid:

1. The Will was incorrectly executed

In other words, the Will was not signed according to the legal standards in the state in which it was created. Though each state has its own specific laws detailing the execution (signing) of a Will, what this generally means is that the Will was either not signed in the presence of two witnesses or was not properly notarized.

2. The Will was fraudulently signed

The testator must be aware that she is signing her Will when she signs the document. If the testator thought she was signing a check or a new car lease, but was actually signing her Will, this would be a case of fraud. Unfortunately, at this point, the testator cannot confirm or deny whether or not she knew she was signing her Will, and not some other document. The witnesses to the signing of the Will must offer their opinion, and the court will decide based on their testimony.

3. The testator lacked the "testamentary capacity" to sign the Will

In order for a Will to be valid, the testator must understand the meaning and effect of signing a Will. This breaks down into three main understandings: an understanding of the types and amount of assets she has, an understanding of the people who will receive those assets (the beneficiaries), and an understanding of the way that the Will distributes those assets to beneficiaries. If the testator did not have the mental capacity to understand these three things, the Will may be deemed invalid. The catch here is that simply because someone suffers from mental illness or deterioration (such as dementia), she's not necessarily lacking in testamentary capacity. The court will have to look at the testator's medical records and the testimony of those people who witnessed the signing of the Will, and will decide on the testator's mental capacity based on that information.

4. The Will was signed under "undue influence"

If someone—a friend, caretaker, family member, professional advisor, or beneficiary named in the Will — pressured the testator into changing the Will, it can be argued that the testator did not freely sign the Will. This pressure can take the form of physical intimidation or abuse, or emotional manipulation or abuse. In order to prove this abuse of power, however, the person contesting the Will must show evidence of this pressure, such as the presence of the beneficiary influencer at the signing of the Will, any role the influencer had in drafting the Will, and if the influencer paid for or stored the Will for the testator.

Aside from incorrect execution, none of these scenarios are simple to prove in court — given the fact that the testator cannot speak for herself, it's up to the living to speculate and provide supporting evidence. In the case of Ms. Clark's Will, her extended family is likely arguing that her attorney, accountant, and nurse exerted undue influence over her, and forced her to sign a Will that would benefit them. As the attorney, accountant, and nurse fiercely deny this claim, it was now up to the courts to prove the invalidity of Ms. Clark's Will.

Asset Distribution And Pie Charts, Pie Charts, Pie Charts

One of the reasons that Huguette Clark's family contested the validity of her Will is because of the stark differences in the content of the last two Wills she wrote. Not only were they written and signed only six weeks apart, they offer wildly different visions of how Ms. Clark wanted her assets distributed. To offer some insight, we're delving into how assets can be distributed in a Will. Yes, we'll be using pie charts.

When creating a Will, you have the right to give your assets — money, real estate, art, jewelry, your car, etc. — to whomever you choose: family members, friends, organizations, or institutions. The only people you may not name as a beneficiaries are the people who serve as witnesses to the signing of the Will.

Many people name only one beneficiary in their Will, such as a spouse. (Huguette Clark's first Will named only one beneficiary: her mother.) If you name only one beneficiary, the distribution of your assets would look like this:

Many people also name multiple beneficiaries, such as all their children. (Ms. Clark's second and third Wills both named multiple beneficiaries: her nurse, her extended family, her lawyer, accountant, personal assistant, Beth Israel Hospital, etc.) If you name multiple beneficiaries, you'll need to decide how your assets will be distributed among these beneficiaries. One common method of distribution is to distribute assets equally among beneficiaries, which would look like this:

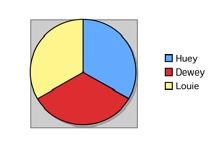

Another common way of distributing assets among multiple beneficiaries is to distribute them unequally. In this case, you'd need to specify in your will how much or what percentage of your estate should go to whom. An uneven distribution can specify how much — in a dollar amount or percentage — each party should get, such as "Huey shall receive 50 percent of Scrooge McDuck's estate, and Dewey and Louis shall each receive 25 percent," which would look like this:

You can also leave a portion of your estate to be divided equally or specifically among a group of people, and also specify that the remainder be distributed equally or specifically to other people or organizations. An example of this type of distribution arrangement would be "Scrooge McDuck's estate is valued at $1,000,000.00. One quarter of the estate will be divided equally between the Phooey Foundation and McDuck College. Of the remaining assets, Huey shall receive $100,000.00, Dewey shall receive $200,000.00, and Louie shall receive $450,000.00," which would look like this:

In addition, you can specify that all your assets be sold and the profits from those sales be distributed equally or unequally among beneficiaries. Or you can decide that certain people should get certain items (Ms. Clark left her nurse, Ms. Peri, her valuable doll collection).

However you choose to distribute your assets in your Will, it's important to remember that, even if you don't have $306,489,687.23 like Ms. Clark, you are communicating a legacy. Though you're under no obligation to inform your beneficiaries of how you've divvied up your assets, communicating your plans can save your family the stress and anxiety of not-knowing, confusion, and even (as in the case of Ms. Clark) doubt.

Doll Collections, Mansions, And Instagram

In Huguette Clark's Wills she included lots (and lots) of money, a Monet "Water Lilies" painting, her Santa Barbara, CA estate, and her doll collection. Based on this wide range of items, it would seem like a person can include nearly anything in her Will. This is pretty much the case… but not entirely. There are certain types of property you can include in your Will, and certain types of property you can't.

The 5 Main Types of Property That Can Be Included in a Will

1. Real property. Real property, as opposed to personal property, includes property such as real estate (houses and apartments, time-shares), land, and buildings.

2. Cash. Not just the cold hard kind, the category of cash can including money in checking accounts, savings accounts, and money market accounts, in addition to the bills hidden in the mattress.

3. Intangible personal property. Intangible personal property makes the jump from things you own that you can hold in your hand or touch (a house, a doll collection) to things you own that exist pretty much as ideas, such as stocks, bonds, LLCs, and other forms of business ownership. Also included in this category is intellectual property, like royalties, patents, and copyrights.

4. Personal property. This is the stuff you own that you can hold in your hand. This category of property includes valuable objects like cars, artwork, jewelry, and furniture. Or a doll collection.

5. Residuary estate. Your residuary estate refers to any assets that you don't specifically leave to anyone. You can name a beneficiary to your residuary estate, known as the “residuary beneficiary,” and this person will inherit all your remaining assets that haven't been specifically left to other beneficiaries.

Seems to cover everything, right? Nope. There are certain things you cannot include in a Will. The things you can't include in your will generally include things you don't own (well, duh) or things you don't own in their entirety (i.e., things you own jointly with someone else), and things that already have a named beneficiary. Here are some examples:

• Your Will can't include property that is held in joint tenancy (meaning you own it equally with someone else), such as a house that you own equally with your spouse. Property held in joint tenancy will automatically transfer to the surviving owner, which means you can't leave it to anyone else.

• Any Trusts, retirement plans, or insurance policies that already have a beneficiary, and any stocks or bonds for which a beneficiary has already been named can't be included in your Will, since you've already named a beneficiary for those items.

And now we come to the topic of digital property. We're talking about your email account, and your Facebook, Twitter, Pinterest, Instagram, personal blogs, and World of Warcraft accounts. While many people consider digital accounts to be property, the law has not yet caught up with this reality. According to those Terms of Service agreements most of us never read, most online companies are legally forbidden from giving the content of your account or access to your account to someone else. In some states (CT, RI IN, ID, OK) you can include login and password information in your will, and your executor will be able to access those accounts. In other states, even if you include the information in your will, your executor won't be able to access your accounts. This is a good reason to write down and store your digital accounts information somewhere safe so that your family can easily access and close your accounts.

The Clark Conclusion

As the case was set to go to trial, a settlement was reached in September, 2013. No criminal charges were filed and NBC News reported the outcome:

The deal gives $34.5 million to Clark's relatives, although her will stated emphatically that they should receive nothing.

These relatives are the great-grandchildren and great-great-grandchildren of Huguette's father from his first marriage. Her father — W.A. Clark, the copper miner and former U.S. senator from Montana who also founded Las Vegas — left equal shares of his fortune to all of his surviving children: Huguette and four of her half-siblings.

The settlement sets up an arts foundation controlling the Clark family's $85 million California summer home at Santa Barbara. That charity is the largest beneficiary of the will, as Clark directed, but with a twist: In the settlement, the foundation isn't set up in California but in New York, with the New York attorney general forming the first board of directors. Seats are reserved for the Santa Barbara community, and Clark relatives also get a seat.

The estate will pay the relatives' taxes and $11.5 million in legal fees. Altogether, about $25 million in legal fees are included in the settlement.

Clark's nurse and companion, Hadassah Peri, who had received $31 million in gifts while Clark lived… has to pay back $5 million to Clark's estate. The advantage for the nurse is that the settlement stops attempts to recover even more of the gifts.

A year later NBC News reported Clark's attorney and accountant wouldn't be charged with any crimes, but they also lost out on millions. You can read all the details here.

You Don't Need $300 Million To Create Your Will

If you're writing your Will, we'd like to congratulate you. We'd also like to suggest that if you have any complicated or tricky assets, or if there's anything you're unsure of, consult a licensed estate attorney in your state. All of this stuff is highly legislated and laws vary from state to state. While it's unlikely to be as complicated as Ms. Clark's estate, the ability to plan ahead and prevent family strife after you're gone is well worth the effort. And if you already have a Will, and need to update it, SHRED THE OLD ONE! An outdated, invalid Will isn't a keepsake. It's a recipe for confusion and disaster.

[via The Washington Post, NBC News: September 2013, September 2014]

- Trusts Cheat SheetTrust us when we say this is as basic as we can make Trusts.Read more

- All You Need To Know About Advance DirectivesWhen you can’t make health decisions for yourself, this is the north star...Read more

- How To Create A Do Not Resuscitate Order (DNR)A DNR is a medical order that states you don't want cardiopulmonary...Read more

- How Organ Donation WorksIf the person who died was a registered organ donor, measures will be taken...Read more